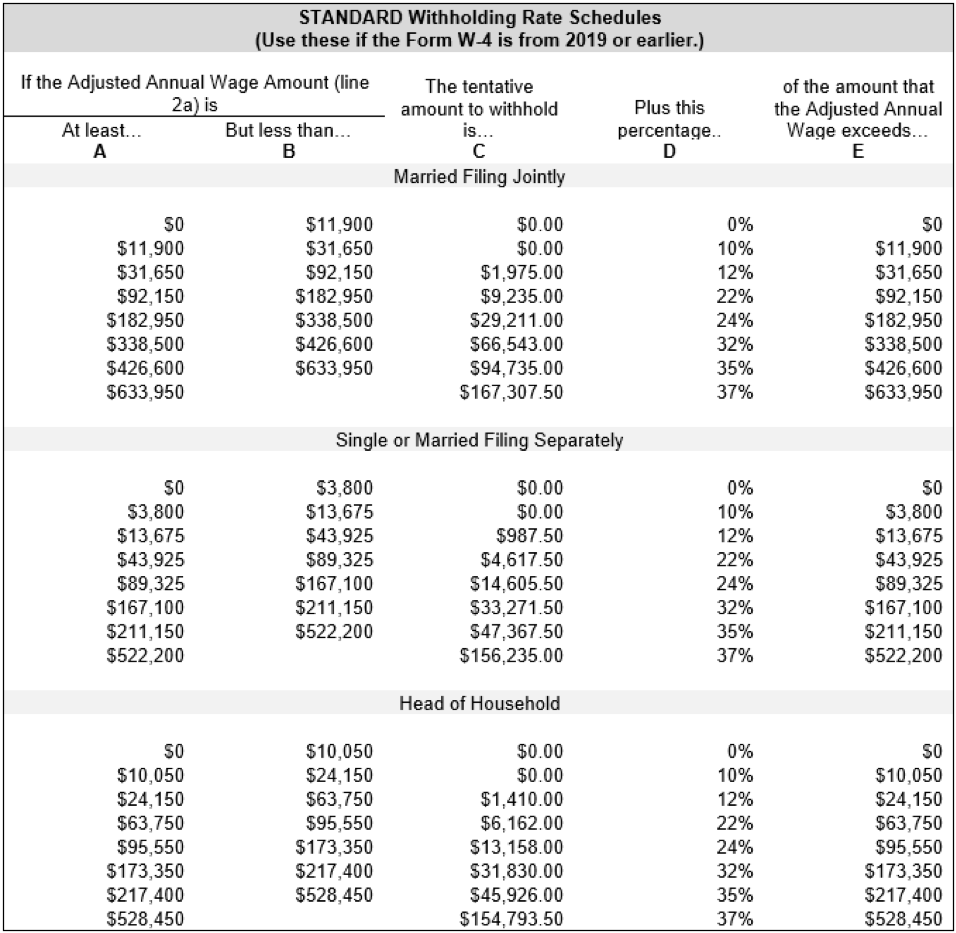

What Does Standard Withholding Table Mean . Let’s say you file under a single status on. it means standard withholding table which is based on the tax withholding tables per irs. I am curious though why you only had $350. Tax withholding counts toward annual taxes. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. If too much money is withheld throughout the year, you’ll. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Federal withholding tables determine how much money employers should withhold from employee wages for federal. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. what are income tax withholding tables?

from brokeasshome.com

your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. it means standard withholding table which is based on the tax withholding tables per irs. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. Let’s say you file under a single status on. I am curious though why you only had $350. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Tax withholding counts toward annual taxes. Federal withholding tables determine how much money employers should withhold from employee wages for federal. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf.

Federal Tax Withholding Tables Texas

What Does Standard Withholding Table Mean if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. Federal withholding tables determine how much money employers should withhold from employee wages for federal. what are income tax withholding tables? it means standard withholding table which is based on the tax withholding tables per irs. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. If too much money is withheld throughout the year, you’ll. I am curious though why you only had $350. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. Let’s say you file under a single status on. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Tax withholding counts toward annual taxes.

From www.taxuni.com

Federal Withholding Tables 2024 Federal Tax What Does Standard Withholding Table Mean An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. I am curious though why you only had $350. it means standard withholding table which is based on the tax withholding tables per irs.. What Does Standard Withholding Table Mean.

From terrapsychology.com

How to Calculate Payroll Taxes, Methods, Examples, & More (2022) What Does Standard Withholding Table Mean Federal withholding tables determine how much money employers should withhold from employee wages for federal. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. it means standard withholding table. What Does Standard Withholding Table Mean.

From federalwithholdingtables.net

Federal Exemptions Standard Withholding Table 2021 Federal What Does Standard Withholding Table Mean it means standard withholding table which is based on the tax withholding tables per irs. what are income tax withholding tables? if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. Tax withholding counts toward annual taxes. Let’s say you file under a single status. What Does Standard Withholding Table Mean.

From exompxsrx.blob.core.windows.net

Standard Withholding Rate at Erik Laird blog What Does Standard Withholding Table Mean If too much money is withheld throughout the year, you’ll. Tax withholding counts toward annual taxes. Let’s say you file under a single status on. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. if you're an employer with an automated payroll system, use worksheet 1a and the percentage. What Does Standard Withholding Table Mean.

From federalwithholdingtables.net

Biweekly Federal Withholding Tables Federal Withholding Tables 2021 What Does Standard Withholding Table Mean withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. what are income tax withholding tables? If too much money is withheld throughout the year, you’ll. withholding tax is income tax. What Does Standard Withholding Table Mean.

From federal-withholding-tables.net

IRS Withholding Tables 2021 Calculator Federal Withholding Tables 2021 What Does Standard Withholding Table Mean withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Federal withholding tables. What Does Standard Withholding Table Mean.

From federalwithholdingtables.net

Higher Federal Withholding Table Vs Standard 2021 Federal Withholding What Does Standard Withholding Table Mean If too much money is withheld throughout the year, you’ll. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. what are income tax withholding tables? it means standard withholding table. What Does Standard Withholding Table Mean.

From bernadinewlayla.pages.dev

Standard Withholding Table 2024 rici demetra What Does Standard Withholding Table Mean withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. Federal withholding tables determine how much money employers should withhold from employee wages for federal. if you're an employer with an automated. What Does Standard Withholding Table Mean.

From governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue What Does Standard Withholding Table Mean your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. Federal withholding tables determine how much money employers should withhold from employee wages for federal. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. what are income tax withholding tables?. What Does Standard Withholding Table Mean.

From www.springfieldnewssun.com

Here's why there's more money in your paycheck What Does Standard Withholding Table Mean If too much money is withheld throughout the year, you’ll. I am curious though why you only had $350. Tax withholding counts toward annual taxes. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs.. What Does Standard Withholding Table Mean.

From brokeasshome.com

Payg Withholding Tables Monthly What Does Standard Withholding Table Mean what are income tax withholding tables? Tax withholding counts toward annual taxes. it means standard withholding table which is based on the tax withholding tables per irs. If too much money is withheld throughout the year, you’ll. Let’s say you file under a single status on. An employer generally withholds income tax from their employee’s paycheck and pays. What Does Standard Withholding Table Mean.

From federalwithholdingtables.net

How To Calculate Federal Tax Withholding Tables Federal Withholding What Does Standard Withholding Table Mean Federal withholding tables determine how much money employers should withhold from employee wages for federal. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. your effective. What Does Standard Withholding Table Mean.

From quickbooks.intuit.com

Federal withholding tax tables A guide for 2023 QuickBooks What Does Standard Withholding Table Mean if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. If too much money is withheld throughout the year, you’ll. what are income tax withholding tables? withholding. What Does Standard Withholding Table Mean.

From maritawsusan.pages.dev

2024 State Withholding Tables Patti Andriette What Does Standard Withholding Table Mean Tax withholding counts toward annual taxes. if you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure. If too much money is withheld throughout the year, you’ll. your effective tax rate is based on a federal withholding table that accommodates for your unique scenario. Federal withholding tables. What Does Standard Withholding Table Mean.

From bernadinewlayla.pages.dev

Standard Withholding Table 2024 rici demetra What Does Standard Withholding Table Mean I am curious though why you only had $350. it means standard withholding table which is based on the tax withholding tables per irs. If too much money is withheld throughout the year, you’ll. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Let’s say you file under a. What Does Standard Withholding Table Mean.

From www.youtube.com

Withholding Taxes How to Calculate Payroll Withholding Tax Using the What Does Standard Withholding Table Mean Federal withholding tables determine how much money employers should withhold from employee wages for federal. I am curious though why you only had $350. Tax withholding counts toward annual taxes. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Let’s say you file under a single status on. . What Does Standard Withholding Table Mean.

From employeepayrollyuhokoku.blogspot.com

Employee Payroll Employee Payroll Withholding Tables What Does Standard Withholding Table Mean I am curious though why you only had $350. An employer generally withholds income tax from their employee’s paycheck and pays it to the irs. withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. it means standard withholding table which is based on the tax withholding tables per irs.. What Does Standard Withholding Table Mean.

From federalwithholdingtables.net

2021 IRS Tax Brackets Table Federal Withholding Tables 2021 What Does Standard Withholding Table Mean If too much money is withheld throughout the year, you’ll. it means standard withholding table which is based on the tax withholding tables per irs. Federal withholding tables determine how much money employers should withhold from employee wages for federal. withholding tax is income tax withheld from an employee's wages and paid directly to the government by the. What Does Standard Withholding Table Mean.